Les craintes persistantes d’une éventuelle récession économique alimentées par divers facteurs pèsent sur les marchés financiers.

avril 14, 2023

Accès au crédit – La clé de l’inclusion financière

avril 14, 2023Les spéculations sur la prochaine décision de la Fed et les conséquences d’une guerre sans fin en Ukraine font craindre les investisseurs.

Markets

Événements qui façonnent les marchés financiers

Les spéculations sur la prochaine décision de la Fed et les conséquences d’une guerre sans fin en Ukraine font craindre les investisseurs.

— 20 juillet 2022

Les spéculations sur la prochaine décision de la Fed et les conséquences d’une guerre sans fin en Ukraine font craindre les investisseurs.

Last week was quiet until Thursday, after the ECB’s interest rate decision. During her speech, President Christine Lagarde declared “Inflation is too high and we must reduce it”. As a result, the ECB has committed to raising its key rates twice by September. The first increase of 0.25 points will take place at its meeting on July 21. A second, the extent of which remains to be decided, will follow in September.

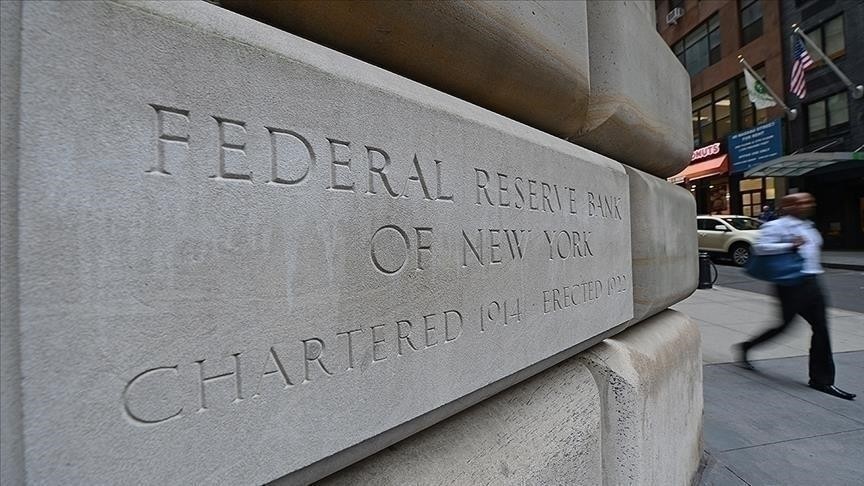

In the same week, the US CPI (Consumer Price Index) was released, against all expectations, it climbed 8.6% last month compared to the previous year. Therefore, this surge in US inflation is fueling bets that the Federal Reserve will become more aggressive in an attempt to ease price pressures.

The financial markets reacted following these events. US and Asian stocks tumbled and Treasury yields rose on Friday. The U.S. dollar hit heights it hadn’t seen in over twenty years. Europe’s single currency held steady at $1.0407, after losing 3.04% in a month. Bitcoin fell around 4.5% on Tuesday to a new 18-month low, extending Monday’s 15% slide.

This week will release the Fed’s interest rate decision on Wednesday. Market participants fear that aggressive interest rate hikes could push the world’s largest economy into recession. Will the flow of refuge continue this week?

Written by Steve Keutcha – Head of Trading